BREAKING NEWS

View Breaking News from Fisher Capital and the industry.

The S&P 500 could crash nearly 50% as a brutal recession takes hold, veteran technical analyst warns

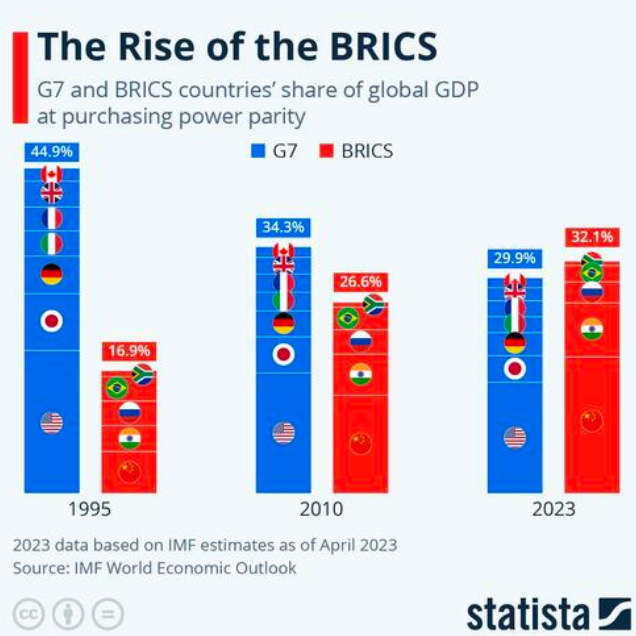

Veteran technical analyst Milton Berg warns of a potential 50% crash in the S&P 500 as the US economy heads into a severe recession. Highlighting concerns about Wall Street's complacency regarding recession risks and noting the economy's weakness could worsen. Berg also points to potential losses in fixed-income portfolios due to rising interest rates, with Silicon Valley Bank's troubles as an early warning. He cites technical indicators suggesting a bear-market rally and a rare money supply decline as worrisome factors. Berg anticipates a recession and a possible banking crisis that could lead to a 20% to 45% drop in the S&P 500.

TO READ MORE VISIT:

https://markets.businessinsider.com/news/stocks/stock-market-outlook-crash-berg-economy-recession-svb-banking-crisis-2023-9

Trader who predicted 2008 financial crisis bets $1.6bn on stock market crash by end of 2023

Michael Burry, known for correctly predicting the 2008 housing market collapse and portrayed in "The Big Short," is now forecasting a Wall Street crash by the end of this year. Burry has reportedly placed bets exceeding $1.6 billion on this event occurring in 2023. Recent SEC filings reveal his negative options on the S&P 500 and Nasdaq 100, both representing the broader US economy. Burry is said to be committing over 90% of his portfolio to this market downturn prediction. His fund, Scion Asset Management, has acquired substantial stakes in put options for these stock-market indexes, providing the right to sell assets at specific prices.

TO READ MORE VISIT:

https://www.independent.co.uk/news/world/americas/michael-burry-stock-market-big-short-b2395947.html

The S&P 500 is massively overvalued - and likely to plunge like it did last year, top economist David Rosenberg says

David Rosenberg, President of Rosenberg Research, is warning investors to prepare for a potential repeat of last year's stock market slump, citing factors like China's deflation, US government credit rating downgrade, and a looming credit crunch. He highlights overvaluation in US stocks, low equity-risk premiums, and suggests investors consider undervalued US Treasuries, stocks in Canada and Asia (excluding China), and gold. Rosenberg has been cautioning about economic risks and consumer debt amid rising inflation and interest rates, comparing the current market hype to historical market crashes.

TO READ MORE VISIT:

https://markets.businessinsider.com/news/stocks/stock-market-outlook-crash-spx-david-rosenberg-china-downgrades-2023-8

MORE NEWS