BUY PHYSICAL GOLD AND SILVER NOW

ANSWERS TO COMMON QUESTIONS

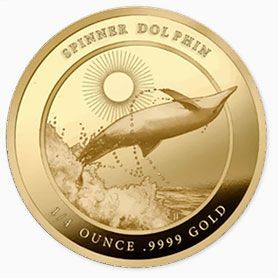

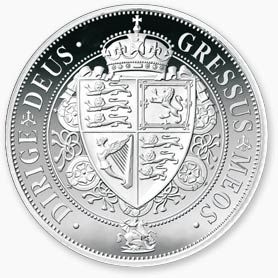

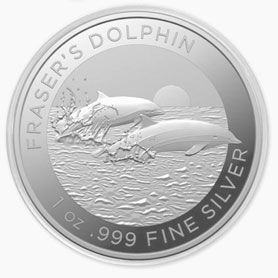

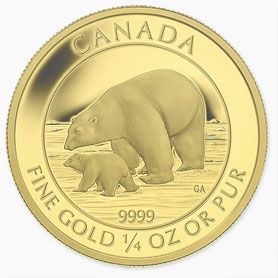

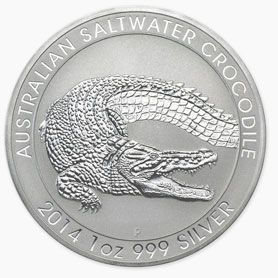

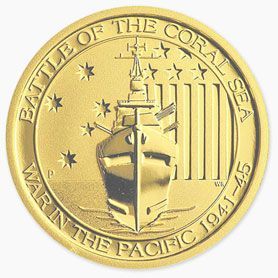

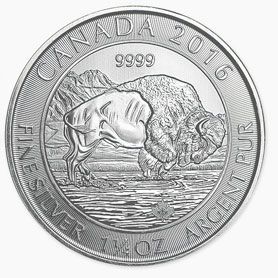

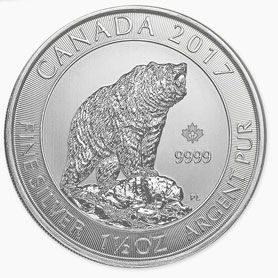

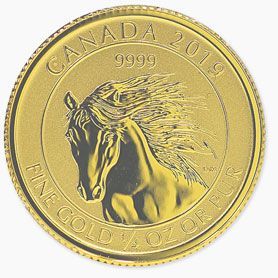

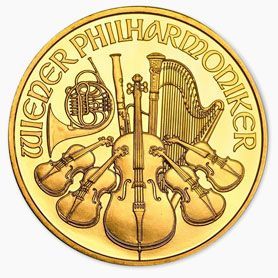

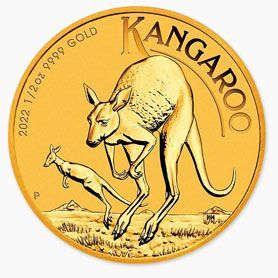

Looking to diversify and buy gold and silver bullion or exclusive coins? Gold and silver are simple to understand and easy to acquire. Especially with our precious metals specialists standing by to help.

Here you’ll find answers to common questions that often come up when people want to buy gold and silver bullion or coins.

Please

call us now if there is a question we can answer for you or you want to learn more about gold for retirement and investment.